The chemical industry is a critical component of life in the 21st century. This industry provides raw materials for endless products that are essential to everyday lives worldwide. Global supply chains that link manufacturers, suppliers, and distributors in a complex commerce system are vital to industry operations. They have been finely tuned over the last several decades to maximize efficiency and reduce costs to ensure a reliable flow of chemicals to markets worldwide.

As we have all experienced in recent years, the global supply chain has its share of challenges. The current drought in the Panama Canal and regional conflict in the Suez Canal has exposed vulnerabilities of international trade routes. These disruptions have caused a ripple effect throughout the chemical industry that directly impact production, distribution, and availability of essential chemicals.

Despite these challenges, the chemical industry remains diligent by finding new ways to ensure a reliable supply of chemicals. In this article, we will discuss the role of global supply chains in the chemical industry, its current challenges, and the strategies Noah Chemicals is implementing to ensure a reliable supply of essential chemicals.

The Panama Canal Drought: A Ripple Effect on Global Trade

The primary trading route between the United States and Asia is the Panama Canal. It is one of the world’s most important maritime routes with 40% of the global ship traffic utilizing this pass.

In 2023, a severe drought hit the region, resulting in a significant decrease of the canal’s water levels and reservoirs. This drought has forced authorities to implement a 36% decrease in cargo ship crossings. In the first quarter of 2024, the daily ship crossing was cut to 24 from the standard 38 during the same period last year.

The result was a 20% decrease in cargo and 791 fewer ships from the first quarter of 2023. For February 2023, 18 ships would be allowed to pass through per day. In addition to the number of vessels that can pass through, limitations have been placed on the depth of ships (draught). This draught limitation has resulted in vessels being unable to carry their full loads and slower ship passages. Canal tariffs have also been increased as of January 1 of this year to a $150 Panama Adjustment Factor per 20-foot equivalent unit.

These restrictions have led to longer shipping routes and shipping delays of up to two to three days. These delays result in longer lead times thereby increasing consumer prices and risk of environmental harm due to increased ship emissions.

Impacts on the Chemical Industry and Shipping Routes

The chemical industry relies heavily on the Panama Canal for transporting raw materials and finished products. Precise timing and scheduling are crucial to ensuring that products reach their destination on time. Delays can disrupt production schedules and without proper contingency planning leads to inventory shortages and increased manufacturing costs.

Many shipping companies are implementing alternative solutions to bypass the Panama Canal to mitigate challenges. For example, to reach the U.S.’s west coast ports, some companies are utilizing the Panama Canal Railway to transport cargo across Panama. Companies are utilizing this rail to temporarily offload container weight in order to meet the new drought-related restrictions. However, some companies are not choosing this strategy, claiming insufficient rail capacity for their larger ships. Instead, they are taking their Cargo to the southern or eastern ports of the U.S. and using the rail system to transport to their intended destination. In an attempt to reduce the longer shipping times, vessels are increasing their speeds. However, increasing transit speeds requires more fuel, resulting in higher transportation costs and increased emissions.

All these factors have caused significant congestion at U.S. ports, resulting in bottlenecking and challenges in moving goods efficiently. This has directly increased prices for petrochemicals such as benzene, ethylene, and methanol.

The Panama Canal drought has compounded disruptions in the global shipping network. Many companies seeking to avoid the Red Sea due to attacks on vessels by Iranian-backed Houthi militants are unable to use the alternative route through the Panama Canal.

Regional Conflict: Security Concerns and Market Volatility

Regional conflict in the area has resulted in a series of attacks on vessels traveling through the Red Sea up to and through the Suez Canal since November 2023. These attacks have resulted in 70% of cargo ships avoiding the Red Sea. While these incidents have not yet led to widespread disruption, they have resulted in longer transportation times, costs, congestion, and increased tariff fees at ports.

Effects on Shipping Routes

The Suez Canal is a trade route that connects the Red Sea and the Mediterranean Sea. The canal provides a vital trade route between Europe and Asia as well as Asia and the east coast of the U.S. The Suez Canal accounts for 12% of global trade, which equates to nearly 1/3 of the global cargo ships. It is currently blocked due to hostilities in the region, resulting in ships being redirected to pass around Africa. This route adds 3,000 nautical miles and 8 to 10 days of transit time. These disruptions are impacting capital goods and fertilizers the most.

The South African ports are not equipped to handle the number of vessels that are now passing through them to avoid regional conflict in the Red Sea. The increase in vessel traffic has resulted in congestion that has severely impacted the country’s import and export operations, which were already struggling before the rise in vessel traffic due to the regional conflict.

Between November 23 and 30 of last year, an estimated 79 vessels carrying more than 61,000 containers at the Port of Durban were forced to remain at outer anchorage due to port operation issues and bad weather. Other ports, such as the Port of Cape Town, experienced similar issues. This resulted in significant congestion along the entire Eastern Cape coastline, with more than 46,000 containers stuck outside Ngqura and Gqeberha ports in late November 2023. Congestion has slowly started to ease at the ports. However, experts claim that the port terminals will likely take until the middle of 2025 to regain optimal functionality.

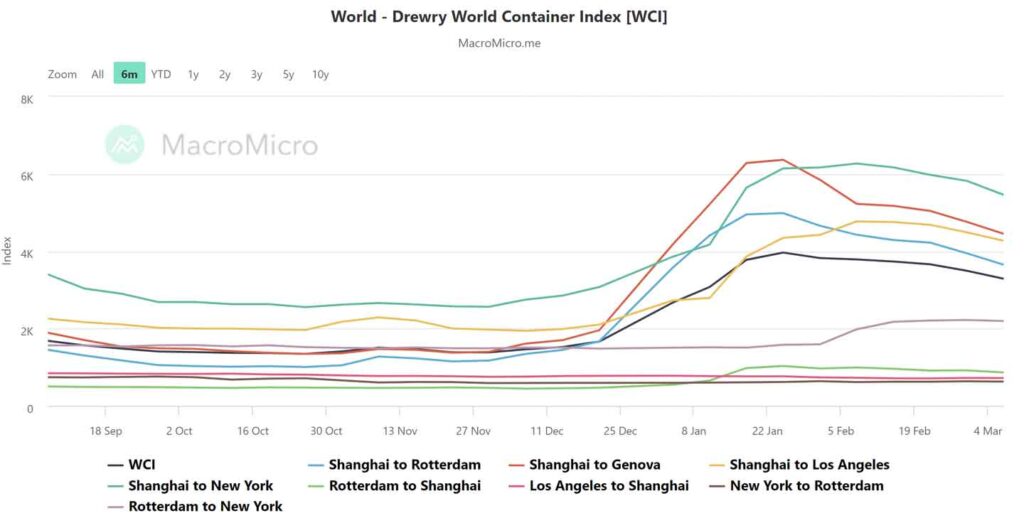

The geopolitical tensions in the region have not only resulted in increased crude oil prices but also elevated freight and insurance costs and led to significant shipping delays.

Potential Cost Implications

The Panama Canal drought and the regional conflict in the Red Sea have several cost implications for global trade and industries relying on these critical maritime routes.

Increased Transportation Costs

The reduction in capacity of the Panama Canal and the need to avoid conflict zones in the Red Sea has forced ships to take longer alternative routes, such as around the Cape of Good Hope. This has increased fuel consumption and extended transit times, leading to higher transportation costs.

Additionally, the disruption of these key shipping lanes has led to a shortage of available vessels, driving up freight rates and further elevating transportation expenses for companies.

Insurance Premiums

The heightened risk of attacks in the Red Sea and potential cargo delays due to the Panama Canal’s reduced capacity has resulted in higher insurance premiums for shipping companies. These increased costs will likely be passed on to customers, affecting the overall cost of goods transported through these routes.

Disruptions

To buffer against potential delays, companies may need to maintain larger inventories, leading to higher warehousing and inventory carrying costs. Delivery delays can also result in penalties or loss of business, especially for time-sensitive goods, further impacting the bottom lines of companies in industries across the board.

Commodity Prices

Additionally, the increased cost of transportation and potential delays in receiving raw materials can lead to fluctuations in the prices of commodities, impacting production costs for various industries.

Operational Costs

Companies may need to invest in additional contingency planning and risk management strategies to mitigate the impact of these disruptions, adding to operational costs. Exploring alternative sources of raw materials or finished goods to avoid affected areas can also incur additional costs in terms of sourcing and logistics.

Mitigating Global Supply Chain Disruptions: Noah Chemicals’ Proactive Approach

In the face of global disruptions caused by the Panama Canal drought and regional conflict in the Red Sea, Noah Chemicals remains steadfast in our commitment to customers. We understand the impact these events have on the supply chain, and we are actively mitigating these challenges to ensure stability and reliability for our partners. Our mitigation strategies include:

- Developing and maintaining strategic partnerships while negotiating bulk deals and prices

- Maintaining inventory levels and studying regulatory trends

Strategic Partnerships and Bulk Deals

To mitigate disruptions, the team at Noah Chemicals is working closely with our partners in Europe and Asia as well as domestic suppliers. We aim to keep pricing stable for our customers by negotiating bulk deals. We also work to optimize freight routes to ensure timely delivery of products despite the challenges posed by current events.

Inventory Management and Price Negotiation

Maintaining adequate inventory levels is crucial especially during times of supply chain disruption. Noah Chemicals is diligently managing our inventory to prevent any shortages. Additionally, we are constantly negotiating with suppliers to ensure that prices remain fair and competitive even in the face of rising costs.

Regulatory Trends and Cost Management

We continually monitor regulatory trends that may impact supply. We adapt our strategies accordingly and minimize potential disruptions by staying ahead of these developments. Our goal is to ensure that our products remain affordable for our customers.

Commitment to Our Customers

At Noah Chemicals, we understand that these are challenging times for everyone. We want our customers to know that we are here for them, working tirelessly to navigate the complexities of the global supply chain. We will continue to do everything in our power to provide our customers with stability and reliability they require.

Noah Chemicals is actively addressing the global supply chain disruptions caused by the Panama Canal drought and regional conflict in the Red Sea. Through proactive monitoring, strategic partnerships, inventory management, and regulatory vigilance, we are committed to maintaining supply chain stability and keeping prices stable for our customers.